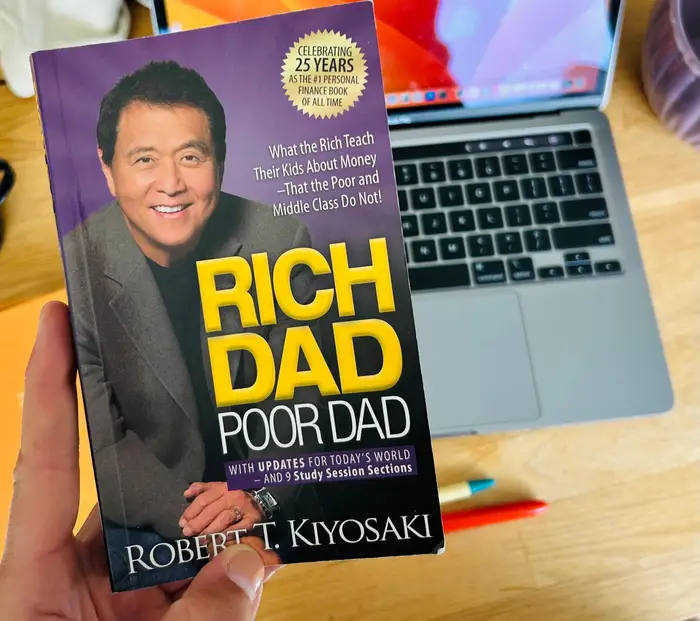

Book “Rich Dad Poor Dad” by Robert Kiyosaki is a personal finance classic that contrasts the financial philosophies of two father figures in Kiyosaki’s life: his biological father, the “Poor Dad,” and his best friend’s father, the “Rich Dad.” The narrative unfolds as Kiyosaki shares the lessons learned from both men, emphasizing the importance of financial education and the differences in mindset that can lead to wealth or poverty.

The Poor Dad represents traditional views on education and work. He was well-educated, holding a stable job and adhering to the conventional path of climbing the corporate ladder. He believed in the value of formal education and sought security through a steady paycheck. However, despite his intelligence and hard work, he struggled financially and lived paycheck to paycheck. His approach to money was rooted in fear and caution, which ultimately limited his financial potential.

In contrast, Rich Dad embodies an entrepreneurial mindset, emphasizing the importance of financial literacy and investment. He dropped out of school and took risks to create businesses and generate wealth. Rich Dad taught Kiyosaki that making money work for you is essential, advocating for acquiring assets rather than liabilities. This shift in perspective highlights the difference between working for money and having money work for you. The core message is that financial independence comes from understanding how money operates, investing wisely, and leveraging opportunities.

Kiyosaki outlines key lessons learned from his Rich Dad, beginning with the importance of financial education. He argues that schools do not adequately teach students about money management, which leaves many adults ill-equipped to handle their finances. Instead of merely earning a paycheck, Kiyosaki emphasizes the necessity of learning about assets, liabilities, and cash flow. He distinguishes between the two, explaining that assets put money in your pocket, while liabilities take money out.

Another crucial lesson is the concept of entrepreneurship and the importance of taking risks. Rich Dad taught Kiyosaki that owning a business and investing in real estate are powerful means of wealth accumulation. This entrepreneurial spirit encourages innovation and adaptability, key traits for succeeding in a rapidly changing economy. By fostering a mindset that embraces challenges and views failures as learning opportunities, individuals can better navigate financial landscapes.

Kiyosaki also addresses the role of taxes and corporations in wealth creation. He explains how the rich leverage corporations to protect and grow their wealth, benefiting from tax advantages that are often unavailable to employees. This insight into the tax system highlights the need for understanding legal financial structures to optimize personal wealth.

The book further delves into the psychological aspects of money, including the importance of mindset. Kiyosaki argues that many people are hindered by limiting beliefs about money, often rooted in societal norms and fear of failure. He emphasizes the need to adopt a mindset that embraces abundance and the possibilities of financial freedom. This shift can empower individuals to pursue opportunities that might initially seem daunting.

Throughout “Rich Dad Poor Dad,” Kiyosaki underscores the significance of financial independence and self-reliance. He encourages readers to become proactive about their financial education, seeking out resources, mentors, and experiences that build wealth knowledge. He stresses that taking control of one’s financial future is essential, rather than relying on employers or the government.

The narrative is punctuated with anecdotes and personal experiences that illustrate the principles discussed. Kiyosaki shares stories of his own financial journey, including failures and successes, which humanize the concepts and make them relatable. These real-life examples serve to reinforce the book’s messages and demonstrate that wealth-building is a process that involves persistence, learning, and adaptability.

Kiyosaki also critiques the conventional wisdom surrounding money, highlighting the limitations of a traditional education system that focuses solely on academic achievement. He asserts that financial education should be a priority, advocating for teaching children about money from a young age. By equipping future generations with financial knowledge, society can cultivate a culture of financial literacy and independence.

In summary, “Rich Dad Poor Dad” serves as a guide to understanding money and building wealth through financial education, risk-taking, and a proactive mindset. Kiyosaki’s contrasting depictions of his two father figures provide valuable insights into the divergent paths of financial success and the importance of making informed decisions. By challenging conventional beliefs and advocating for a shift in perspective, the book empowers readers to take charge of their financial destinies, ultimately aiming for a life of abundance and financial freedom.